Imagine the price of Solana relative to the collapsed FTX..is it reachable

Imagine the price of Solana relative to the collapsed FTX..is it reachable

Blockchain Foundation delays decryption project

31 million Solana tokens have been deregistered, following warnings that some investors will try to redeem their holdings as digital asset prices fall. Blockchain SOL Thursday by Blockchain Security Mechanism.

In contrast, Solana’s price rose on digital asset markets when the Solana Foundation announced it would delay plans to scrap about 28.5 million tokens.

After the expiration of the Solana blockchain, 63 million Solanas are ready to be unlocked, according to a statement issued by the Solana Foundation on Thursday.

On Wednesday night, the foundation tweeted that due to a policy change by cloud service provider Hetzner on November 2, about 28.5 million SOL tokens that were supposed to be scrapped have been reinstated.

As part of the mandate initiative, the Solana Foundation has made bets already owned by the foundation, the tweet says.

Given recent events related to the FTX (FTT) decline and Solana’s relationship with FTX, technical expectations have pointed to a fall in Solana prices due to an unexpected surge in supply.

Solana developers were given extra time to offload their SOL tokens at the current price, before the token’s value plummeted, keeping the SOL price somewhat stable due to the delay in unlocking. But at the same time, FTX’s bankruptcy is adding pressure on Solana’s price.

What does Solana and FTX have to do with each other?

The price of Solana, one of the week’s hardest-hit digital assets, fell further on Friday after the company filed for bankruptcy protection, amid a sharp sell-off across all cryptocurrency markets due to FTX’s sharp decline.

Solana attracted various private investors in 2021, including Alameda Research, which donated $300 million to sell the company’s original token. Andreessen Horowitz was the lead investor in this round of funding. Fried’s Financial Services maintains its Solana blockchain integration.

Solana prices hit new lows of around $12 earlier this week before rallying 26% to $19 on Thursday. After hearing the news of FTX’s bankruptcy on Friday, the price fell back to around $16, down 6.4% for the day.

Last week, SOL lost 50% of its value. With added volatility, doubts remain about the future of the Solana blockchain and the severity of its potential impact from the FTX bankruptcy.

Solana price prediction

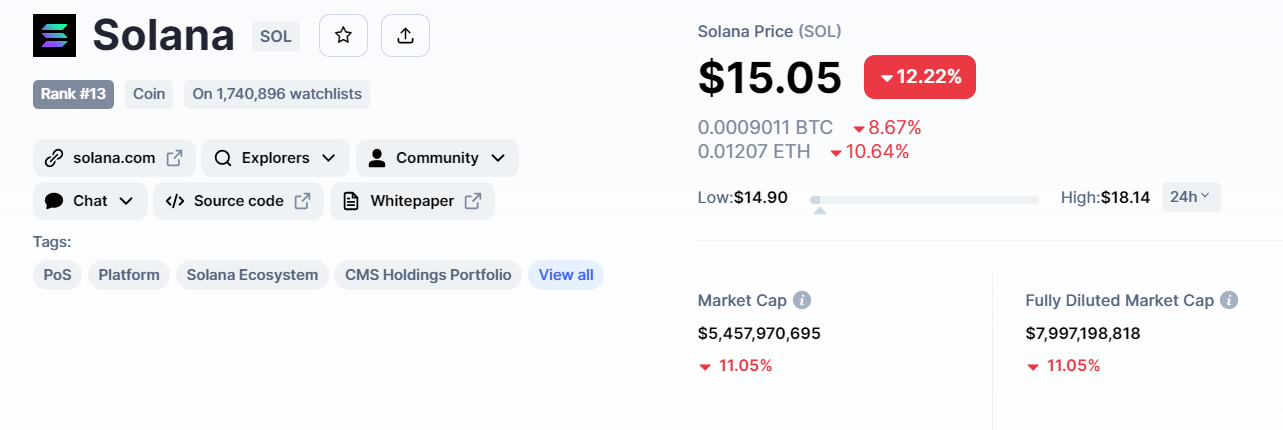

Solana’s current price is $14.93, with a turnover of $1.8 billion in 24 hours. Solana has lost more than 12% in the past 24 hours and 56% in the past seven days. Rated by CoinMarketCap Now it is ranked 13th with a direct market capitalization of $7.9 billion. The circulating supply of SOL coins is 362,631,757.

Solana has so far completed the 38.2% Fibonacci retracement of $21.85 and candles below this level indicate that the downtrend may continue. The SOL/USD pair remains below the 50-day moving average, extending resistance near $26.

As Solana closed the red candle below the $21.85 resistance level, chances of a downtrend continuation are strong.

If sellers push below the immediate support level of $11.50, the SOL price may drop to $5.5.