Introduction to Elliott Wave Theory – Bitcoin Arabs

Introduction to Elliott Wave Theory – Bitcoin Arabs

Introduction to the Elliott Wave Theory It contains the detailed aspects of that theory, which is one of the theories that can predict the financial markets by the trader and predict its movement through the study of past data.. Therefore, who wants to trade with more professionalism, in currencies or stocks, wave analysis Elliot should touch, because it One of the basic tools that allows predicting market movements.

Introduction to Wave Theory Eliot

It is called wave analysis and is a method of analyzing data in financial markets made in the past to predict future movements in the market through several waves that follow certain pattern rules, Elliott waves are one of the methods used in technical analysis to predict market movements in money.

Some traders who rely on the theory of wave analysis rely on the analysis of financial markets, this theory is one of the natural laws that inevitably go, not only as a traditional theory in the financial market, but it can be applied in all fields. Life is not just business.

Wave analysis is a method of analyzing market data because the entire life cycle is nothing but a few rising and falling waves related to the idea of optimism or pessimism in trading, which is related to stability and risk, so the theory wave analysis is the main gateway to understanding financial markets and how they work, it is used in building trading strategies. is the most important method.

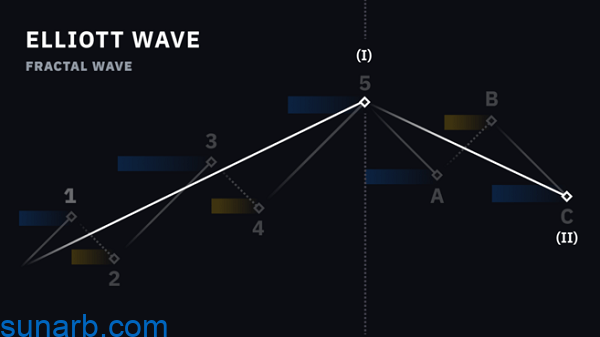

It is a way to predict the movement of financial markets, such as trading currencies or stocks, where the law of the wave principle states that the market should move in two waves: one in the general direction of the market, the other in a correction direction, which is opposite to the general market direction.

For the first time, the theory of wave analysis was disseminated by the American accountant “Ralph Nelson” and it was in the thirties of the last century, when he was able to study 75 years of stock, he is considered the first founder of wave analysis. market data, and said that these markets do not move according to a random movement, but can be expected to move following certain laws.

Principles of wave theory Eliot

Wave theory says that its principles are that financial markets move according to two waves and each of them is divided into several waves, and the whole wave cycle is called and each wave cycle is considered as a larger part. One, eight absolute waves are divided into corrective waves in their time frame and others are excitatory;

How are waves calculated? Eliot?

In the introduction to Elliott wave theory, we mention that waves are counted in cycles, a cycle consists of 8 waves: 5 in the price direction + 3 in the opposite direction.. These three waves are counted as one big wave. A cycle, and another wave in a correction, is the opposite trend in price.

driving waves

Procter defines target waves as always moving in the direction of the price, which is in the direction of the market trend, and impulse waves are divided into 5 small waves, which we mentioned earlier in the Elliott wave introduction. theory, but it has some rules to note:

- Among waves 1, 2, 3, wave 3 is not short, but long.

- Wave 3 moves past the end of the first wave.

- The second wave never retraces more than 100% of the movement of the first wave before it.

- The fourth wave never retraces more than 100% of the movement of the third wave before it.

Corrective waves

In contrast to the previous one, it is often formed by a small corrective wave and is called three ABC waves, when it moves against the direction of the larger market, it represents a fight against the market and it can vary in complexity and length, and one of its main rules is that it does not consist of 5 waves at all, only 3 .This was emphasized by Prector.

Wave analysis

Social psychology is concerned with the trader’s behavior in order to explain it based on the principles of fear or greed. According to it, the Elliott Wave Principle states that the psychology of traders causes the market price movement in each phase of the trend. Therefore the analysis waves correspond to the following:

| First wave | In the beginning you will not see it clearly, because the opposite tendency prevails. |

| Second wave | This is a correction of the first wave, but it does not extend beyond the starting point of the first wave. |

| The third wave | It is considered a long impulse wave as investors start sensing the new price directional movement and get tempted by its reversal. |

| The fourth wave | This is considered to be a previous correction wave, as prices meandered sideways for a long time, retracing less than 2% of the third wave. |

| The fifth wave | It is the latter in the prevailing trend, although it is optimistic about the business movement. |

Also See: What is Technical Analysis?

Significance of the wave Eliot in business

There is debate about the efficiency of Elliott waves, and virtually all can be drawn without breaking Elliott’s basic rules, but it takes a lot of practice and skill, but it is subjective because it is not a reliable theory by its subjective nature. , and some criticize it because it is not precisely defined. Others see only the fact that a large number of traders have achieved success in profiting by applying Elliott’s principles.

Also, there is a growing number of traders and investors working on combining technical indicators such as Elliott Wave Theory and Fibonacci Retracement and Extension, with the aim of reducing risk as well as increasing success rates and profitability.

But we emphasize that the Elliot wave itself cannot be considered as one of the indicators of technical analysis, but it is a theory and there is no correct way to use it, and it is not characterized by an objective nature, so it is not evidence. Accurate prediction of market movements, and relying on it, requires a lot of practice and skill because the trader still needs to know how to draw the waves and their numbers, so if he is one of the beginners, his reliance on the theory does not pose any risk.

How to Trade Elliott Waves in Forex?

Elliott’s Theory is widely relied upon by traders and investors in the forex market, it is one of the most important advanced strategies and the approach followed by professionals in dealing with those waves, it comes as follows:

- The trader chooses a method to start the number of waves

- Wait for the fifth wave

- Confirm trends by clicking on “Indicators”.

- Setting the stop loss point

- Entering into a trade agreement

- Place a stop loss order

- Looking at the best profit points

- Taking into account breakpoints

- Take risk management decision in case of any loss

It is worth noting that Elliott Wave analysis affects forex trading, as there are several ways to define it, and it depends on the business requirements and options, followed in terms of choosing the appropriate method from forex wave analysis.

Elliott Wave Trading Rules

Looking at the introduction to the Elliott wave theory, we found that there are rules for trading using it, which include the following:

- Develop a reliable technique to describe the current Elliott Wave counting method.

- Make sure there is a valid trading signal through any appropriate filter used when trading in wave analysis.

- Determine an appropriate stop-loss point.

- The trader tries to get the desired profit from the first batch of Elliott waves.

- Considering that recent waves are additional opportunities, potential stop-loss orders and instructions are considered to have a high probability of activation.

The best way to experience the practical use of the Elliott Wave indicator is to experiment with the trading platform you used as a trader or investor, keeping in mind what we mentioned in the introduction to the Elliott Wave. In theory, that means the indicator is not easy to use and therefore should be relied upon as an indicator and only secondary with some other indicators in your trading setup.

Some argue that the success rate of an Elliott wave depends primarily on the trader’s ability to accurately segment market movements into intentional and corrective trends.